“Life is in stages. There is a stage where, like grasshoppers, we hop from grass to grass...

And another, where we move from grass to grace.”

― Michael Bassey Johnson, Song of a Nature Lover

Choices

In today's world - whether consciously or not, we have selected particular goods as the item that, for us, successfully meets the need of a given want or desire.

The need or desire for a computer? Some choose Apple, some choose HP.

The need or desire for a day-to-day toothpaste? Some choose Colgate, some choose Arm & Hammer.

You get the idea. But, one thing that people struggle to pause and consider, is the good that meets the need or desire for their money.

Similar to any other need in the world, there are multiple options that can be chosen as the good to serve as your money. But, modern society is set up to try and keep you from realizing that you have options and can make your own decision as to what you consider YOUR MONEY.

What is money? What is YOUR MONEY?

Money is a tool. Usually viewed as an economic tool to help facilitate trade between individuals. Whether it's you and someone else or you and future you.

Money makes the exchange of goods easier so we can all live peacefully.

But there are different goods that can be used for this purpose - as a money.

It could be gold, corporate equity, government IOUs, or the hardest money the world has ever seen...the choice is yours.

I've made the decision to make Bitcoin my money. Similar to this guy below, but unfortunately, I didn't make the decision in 2011.

But, the decision to make Bitcoin my money didn't happen overnight. In fact in hindsight, it was a process that took several months and probably years if I'm being honest with myself.

The Primary Tool

This process to making Bitcoin my money - the primary tool of choice for how I facilitate and measure all my economic trades - and the phases that comprise this process, is the topic of this piece.

I believe that this process is made up of roughly four phases that any economic entity that wants to make Bitcoin their money will go through.

The phases are:

1.) Speculation

2.) Investing

3.) Saving

4.) Money

Although I have presented these phases linearly, in reality, an entity's experience is probably a bit more volatile.

Similar to Bitcoin's USD exchange rate - you may start in one phase, have run ups to a different phase, then "crash" back to the original phase.

But just like BTC/USD - the trend, if you remain consistent, will be up and to the right - until you reach the Money phase for good.

Speculation

The first phase in this process is speculation.

Meaning that, a given individual views their interaction with Bitcoin as a short-term trade to capitalize on any upward or downward volatility within that time frame, to then convert back to USD or whatever their dominant fiat currency, having hopefully increased their personal stack of USD.

There is little to no consideration to the fundamentals in play for either Bitcoin or USD. The halving could be tomorrow, but if there is a sufficient enough rise in price, the individual will sell the Bitcoin for USD, oblivious to the medium-term impact of such an event as the halving.

Here, the main focus is to maximize fiat accumulation. And funny enough, most people who engage in Bitcoin speculation fail at it miserably. Making this exercise akin to gambling at the blackjack table.

Bitcoin punishes your short-term oriented behavior.

Since the likelihood of any material success at this phase of adoption development, the author would humbly suggest that any person in this phase swiftly progress forward to the next phase.

To move into the next phase, you should familiarize yourself with the concept of "value".

Ask yourself what makes a given good valuable in the marketplace? And be able to adequately answer that question.

To understand Bitcoin on a level beyond the unpredictable movements of short-term price action, you will need understand what would cause a given economic actor to trade their goods for another.

Having a workable knowledge of the role value plays in the marketplace is a great first step towards the next phase of Bitcoin adoption.

Investing

In this phase, the individual is a bit more discerning.

Here, they have come to view Bitcoin as something worth accumulating - as an asset, over a longer time horizon, because the potential for fiat gains will be maximized by doing so. Instead of putting themselves at the whim of the daily irrational volatility of the market.

The Investor realizes that in the short term the market is irrational, but on a long enough time scale it is very very rational.

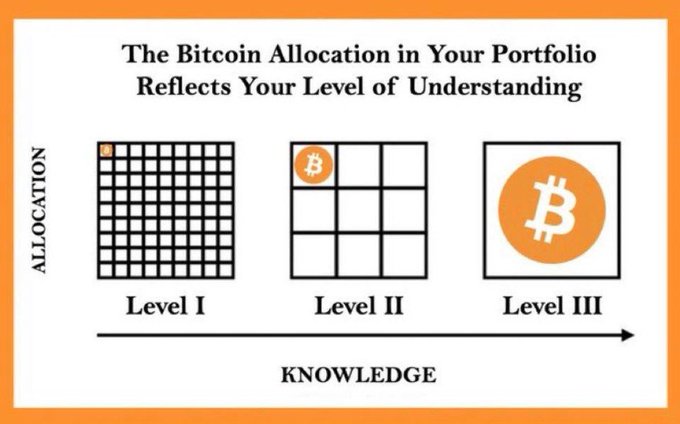

As an investor there is some consideration now to the fundamentals of Bitcoin, they may be aware of the finite supply of 21 million, or have a workable understanding of the mining process. But overall, in comparison to later phases of adoption the fundamental understanding of Bitcoin is relatively superficial.

This phase allows you to not have to focus so much on the day-to-day price action of Bitcoin, you can spend more of your time developing a compelling investment thesis.

The drawbacks of this phase are, like the previous phase, the focus on fiat accumulation. Even though this is on a longer time horizon, which improves the likelihood of nominal increase of fiat, in this phase you are still trapped in fiat thinking which leads to debasement, taxation, "DiVeRsifIcaTion" etc.

Equipped with a clearer understanding of the global market and some of the Bitcoin fundamentals, the next phase adoption becomes possible.

To progress actually only requires one thing...an understanding of time.

The recognition that, if you are accumulating something of value, time is your friend. Time will allow you to deepen your knowledge and conviction, while also allow you to accumulate the inevitable dips along the way dispassionately.

A deeper understanding of time and the role it plays in Bitcoin will help lower your time-preference, allowing you to see beyond the fiat illusion...leading to the next phase.

Saving

You have come a long way. At this point you've crossed the biggest threshold.

You no longer think in terms of fiat.

You see the bright orange truth. The game is Bitcoin accumulation for Bitcoin accumulation's sake. Not to one day convert your hard earned Bitcoin back to infinitely inflatable trash tokens.

You are now a Bitcoin Saver.

Reaching this phase is worthy of celebration. You can officially say you've grokd' Bitcoin.

The recognition of Bitcoin as the ultimate savings vehicle for your time and energy into the future clarifies a lot. You realize that what you have been doing until now has just been a futile search for a vehicle to outrun inflation, you weren't "investing" or "speculating".

The realization that investing is actually a useful profession in a society on a sound money standard, but in fiat land, it is purely a debasement avoidance strategy.

Now, at this stage, ALL your excess income is either quickly converted to Bitcoin or it is already Bitcoin to begin with. You denominate your wealth in Bitcoin and set savings goals to increase your stack.

Absolute scarcity is properly understood.

This phase will allow you to simplify your life. The only number go up you care about it your Bitcoin stack. The fluctuations in USD or whatever local fiat is just background noise getting quieter and quieter.

You can now focus on more worthy endeavors.

But...another phase remains to ascend to. This next phase requires the ability to evaluate with open and clear eyes the most important asset in the world, yourself.

Money

Again, what does it mean to make something YOUR money?

It is the capital good you primarily earn, spend, save and invest.

For this to be the case, the vast majority of your economic energy must be stored in that good.

The dominant lens by which you interact and interpret the market.

Recognize that there is no in-between here.

At all times, something is your primary economic lens by which your economic energy is denominated.

For most of society, that lens is fiat government currency.

But for a select and growing few, that lens is Bitcoin.

This is beyond just saving in the previous phase, it's all encompassing.

When Bitcoin is your money, you are now aligned with absolute scarcity.

You know when you EARN Bitcoin, those earnings can't be debased.

You know when you SPEND Bitcoin that transaction can never be reversed and you have to mentally contend with knowing you have willingly exchanged a definitively scarce object in return for something else.

You know when you SAVE Bitcoin, you will forever have that slice of orange pie, in the same proportion to the whole. 1BTC = 1BTC

You know that when you INVEST your Bitcoin the bar that the return on that investment must meet is very high, that the opportunity cost is the Bitcoin you could have today as opposed to the potential Bitcoin you can have in the future.

But how do you get there...

To get here you have to love yourself, flaws and all. Realize that you owe it to yourself to value all aspects of yourself, from what you put out into the world, and what you receive back.

Your time and energy weather it is being spent or saved is valuable and should be denominated across the board in the something that is commensurate with that value.

Now absolute scarcity is internalized.

I hope this helps. Return to this article from time to time to see where you are and even where others are in their Bitcoin journey. Maybe you can help someone rise through the ranks faster by giving them the key to the next phase.

But that's it for this one. Until next time. Love yourself.

HODL T.