"Complex, adaptive systems grow incrementally. This is the method they use to simultaneously harmonize multiple competing interests, to learn - through experimentation - what truly works and what doesn't."

Charles L. Marohn, Jr.'s "Strong Towns" presents a revolutionary perspective on urban development, advocating for sustainable and incremental growth of towns which directly contrasts to our modern approach, which is to build large projects all at once in a final state, without any concern for its economic viability over time. The book introduces several valuable concepts critical for the effective management of urban areas. However, I believe the insights could be deepened when examined through the framework of Bitcoin as money and an understanding of monetary history. This piece presents a critical analysis of the book, focusing on its core ideas, its limitations, and the potential for broader implications through a Bitcoin-centered perspective.

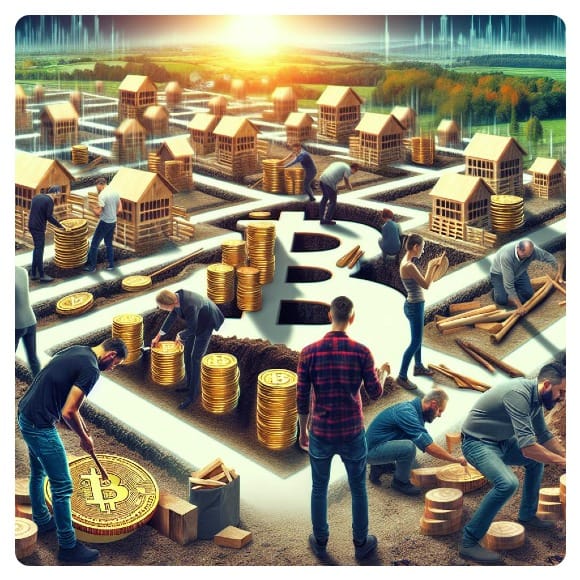

At the heart of "Strong Towns" lies the advocacy for traditional, incremental growth as practiced by civilizations throughout history. Morohn gives compelling examples of this, even using his own hometown to illustrate how our ancestors turned an undeveloped area into a strong capital-intensive city by only building what is absolutely necessary, remaining flexible and only upgrading infrastructure when there is obvious market demand. This approach ensures that resources are utilized judiciously and structures are adaptable to change over time. Marohn underscores the need for governments to prioritize sustainable long-term development rather than rapid, unsustainable growth driven by current cash flow desires. He highlights how infrastructure should be justified by the productivity and wealth it supports, emphasizing the calculation of return on investment (ROI) for public projects, ensuring expenses are justifiable by generated revenue.

In my opinion, this is a solid argument grounded in strong economic logic. The issue I have and would like to focus on is exactly how this "ROI" is calculated and measured.

The ruler is broken. So it doesn't matter what is being measured if the ruler or tool you are using will not give you consistent and uniform measurement. In our global economy, the ruler is the United States dollar.

While Marohn presents his foundational ideas effectively, a deeper understanding of monetary systems could further enrich his arguments. The author demonstrates some awareness of money as a coordination mechanism in an economy but lacks the comprehensive insight possessed by Bitcoin proponents and Austrian economists. This limited understanding, when viewed through the lens of Bitcoin, reveals an incomplete explanation of issues faced by cities, neighborhoods, and broader societal structures.

The core problem that remains unaddressed in "Strong Towns" is the inefficiencies embedded within the current FIAT monetary system, and how this systemic misallocation of capital due to human intervention directly causes all economic planning on top of a given fiat money to lead, predictably to bad outcomes. Placing the control of money in government hands leads to mismanagement of monetary supply, introducing significant volatility into the economy ending finally in hyperinflation. Adopting a Bitcoin Standard offers a plausible solution. Bitcoin, as a decentralized form of currency, presents an opportunity for societies to adopt a monetary standard independent of centralized control, thereby minimizing the economic noise and harm associated with fiat systems.

Bitcoin's fixed supply and decentralized nature offer a new paradigm for assessing urban development decisions. For instance, the incremental approach advocated in "Strong Towns" finds a parallel in the gradual adoption and enhancement of Bitcoin's value without the imposition of external inflationary pressures. Public projects, when assessed on a Bitcoin Standard, would experience less volatility and a more predictable expenditure framework, ensuring sustainable urban growth. This would not only be available to the governing body in a jurisdiction, but also, and in my opinion more importantly, to the individual economic actors that make up the jurisdiction. Using a pristine tool to make economic calculations will enable all those who use it to deal with reality and not abstraction when taking economic action, allowing them to course correct quicker and double down on activity based on the signal they are getting from the market.

Ultimately, while "Strong Towns" provides a commendable framework for rethinking urban development, expanding this framework to include a Bitcoin-based monetary perspective can significantly enhance its potential. Such an integrated approach ensures that urban planning is responsive to immediate economic needs and positioned for long-term sustainability and economic resilience. Through a comprehensive understanding of sound money, societies could embrace a future where both growth and monetary systems resonate with historical prudence and modern efficiency.

HODL T.